The objective of IAS 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of cash flows, which classifies cash flows during the period according to operating, investing, and financing activities. IAS 7 amended by Annual Improvements to IFRSs 2009 with respect to expenditures that do not result in a recognised asset.Įffective date for amendments from IAS 27(2008) relating to changes in ownership of a subsidiaryĮffective date of the April 2009 revisions to IAS 7Īmended by Disclosure Initiative (Amendments to IAS 7)Įffective date of the January 2016 revisions to IAS 7Īmended by Supplier Finance Arrangements (Amendments to IAS 7 and IFRS 7)Įffective date of the May 2023 revisions to IAS 7Īmendments under consideration by the IASB Retitled from Cash Flow Statements to Statement of Cash Flows as a consequential amendment resulting from revisions to IAS 1 IAS 7 Statement of Changes in Financial Position

IAS 15 - Information Reflecting the Effects of Changing Prices (Withdrawn).

IAS 14 - Segment Reporting (Superseded).IAS 10 - Events After the Reporting Period.IAS 8 - Accounting Policies, Changes in Accounting Estimates and Errors.IAS 1 - Presentation of Financial Statements.

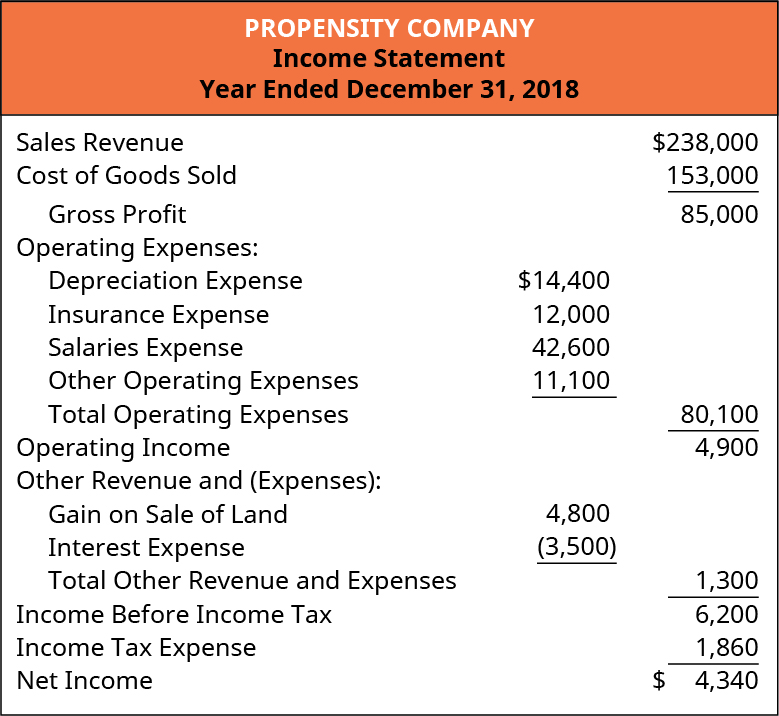

(Accounts Payable, Accrued Liabilities, Income Tax Payable etc. (Accounts Receivable, Prepaid Expenses, Inventory etc.) (Depreciation, Depletion & Amortization Expense) The following is the indirect method formula to calculate net cash flow from operating activities: Since the income statement is prepared on accrual basis in which revenue is recognized when earned and not when received therefore net income does not represent the net cash flow from operating activities and it is necessary to adjust earnings before interest and tax (EBIT) for those items which effect net income although no actual cash is paid or received against them. In indirect method, the net income figure from the income statement is used to calculate the amount of net cash flow from operating activities. Here we will study the indirect method to calculate cash flows from operating activities. The first section of a cash flow statement, known as cash flow from operating activities, can be prepared using two different methods known as the direct method and the indirect method.

0 kommentar(er)

0 kommentar(er)